News Release: While the collection of rent on commercial property at its highest since the start of the pandemic, service charge payments fall back, says Remit Consulting

- Verified figures reveal that, overall, 92.9%, of rents were collected within thirty-five days of the September Quarter Day

- Collection of service charge payments fall by 1.7% compared to the previous quarter

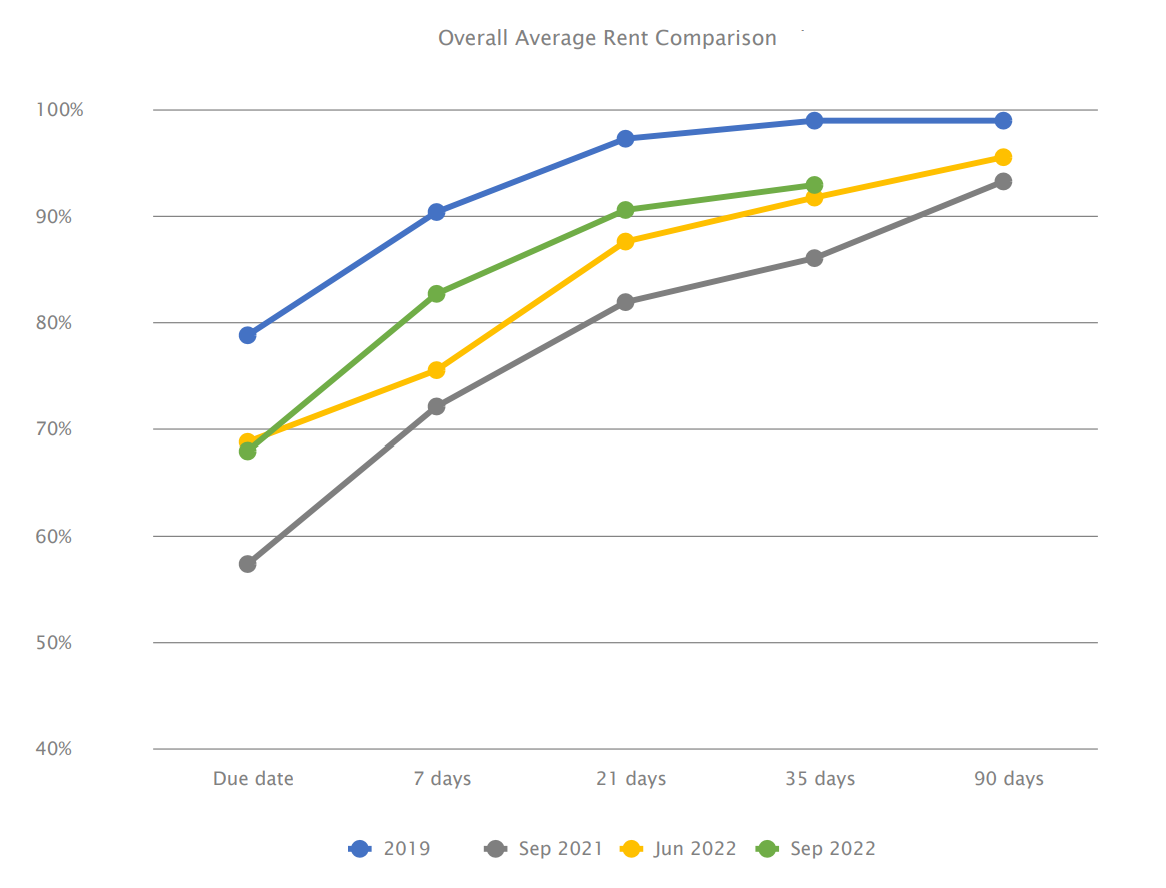

The level of rent collection from business occupiers in the UK, thirty-five days after the September quarter due date, reached 92.9%, the highest level achieved for any quarter during the pandemic so far, according to the latest Remark research from Remit Consulting.

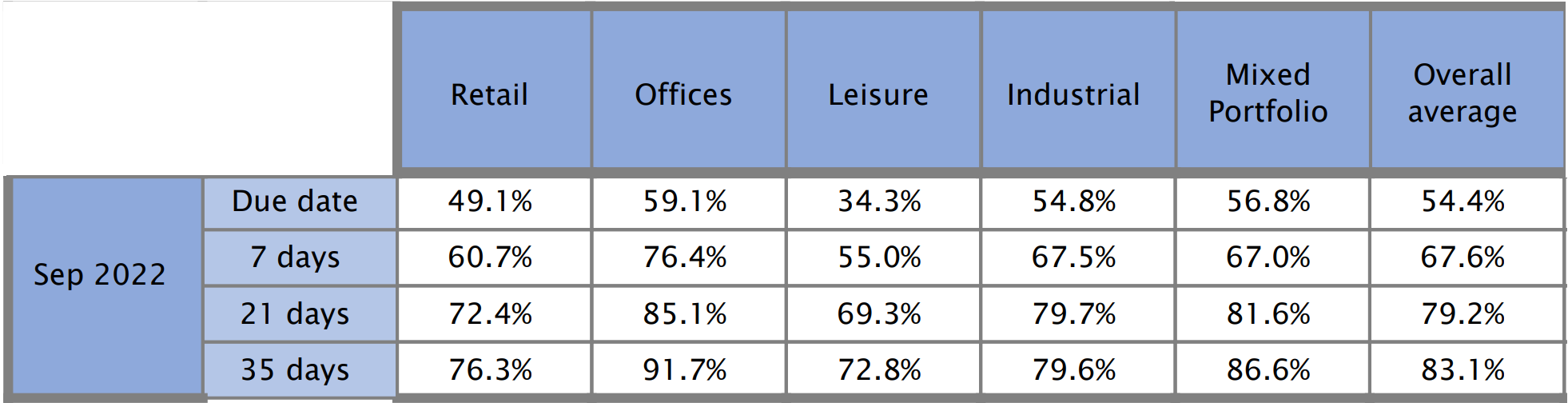

Rent collection at 35 days surpassed the previous quarter by 1.1% and is 6.8% higher compared to the figure for the same quarter in 2021. All sectors have seen an improvement in rent collection at +35 days in comparison to twelve months ago, however, the payment of service charges has slipped compared to the previous quarter.

The office sector saw the highest rent collection rates witnessed since the start of the pandemic, which possibly reflects the gradual increase in the number of staff returning to the workplace, that Remit Consulting has recorded across the country.

Steph Yates of Remit Consulting said: “While the Remark data confirms the highest collection rates so far in the pandemic, the market is still seeing a shortfall compared to the percentage of rents that were being collected pre-Covid.

“The total rent collected at the end of the previous two quarters has not changed and remains below the figures of over 99% experienced before the pandemic, and there is little reason to suspect that there will be a further shortfall to landlords and investors after 90 days.”

Elijah Lewis, the firm’s research consultant, added: “Any reduction of consumer spending due to the cost-of-living crisis, combined with the spiralling costs of energy for businesses, makes it likely that defaults in rent payments will increase.

“While the impact of Covid-19 and the national lockdowns are lessening, the prevailing economic climate is creating uncertainty, and it remains to be seen if the 4-5% shortfall in rent collection witnessed at the end of the past few quarters is repeated in December.”

There is also a shortfall in service charge payments made by commercial tenants, which remain well below pre-pandemic levels. Thirty-five days after the due date, almost 17% of all service charge payments remained uncollected, representing an additional, and significant, shortfall for landlords and investors. There remains a 9.8% gap between rent collection rates and service charge collection rates at the +35 day, up from 8.1% at the same stage in the previous quarter.

“This fall in the payment of service charges may suggest that, as energy prices and other costs increase, businesses might be prioritising rent over service charges,” said Elijah Lewis.

Remit Consulting’s Remark research covers around 125,000 leases on 31,500 prime commercial property investment properties across the country and the firm has recently launched an online portal to make it possible for building managers, investors, and asset managers to benchmark individual properties and portfolios against the market in real-time.

Rent collection rates

Service Charge collection rates

Working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Property Advisors Forum, and other members of the Property Industry Alliance (PIA). Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since March 2020.

With offices in London, Amsterdam and Paris, Remit Consulting is an independent, European management consultancy that has been providing practical, cost-effective, and efficient solutions for the real estate markets for nearly two decades.

Many of Europe’s largest property teams rely on Remit Consulting to help them to innovate and transform their businesses through benchmarking and its in-depth knowledge of business processes; strategies; compliance; real estate finance; system selection and implementation.

For further information, please contact Andrew Barber.

Email:

Phone: +44 (0)7989 553 903