News Release: Rent collection from tenants of UK commercial properties reaches the highest levels since the pandemic began, says Remit Consulting

- Verified figures reveal that, overall, 82.7% of rents were collected within seven days of the September Quarter Day

- Overall quarterly collections have plateaued at around 95%

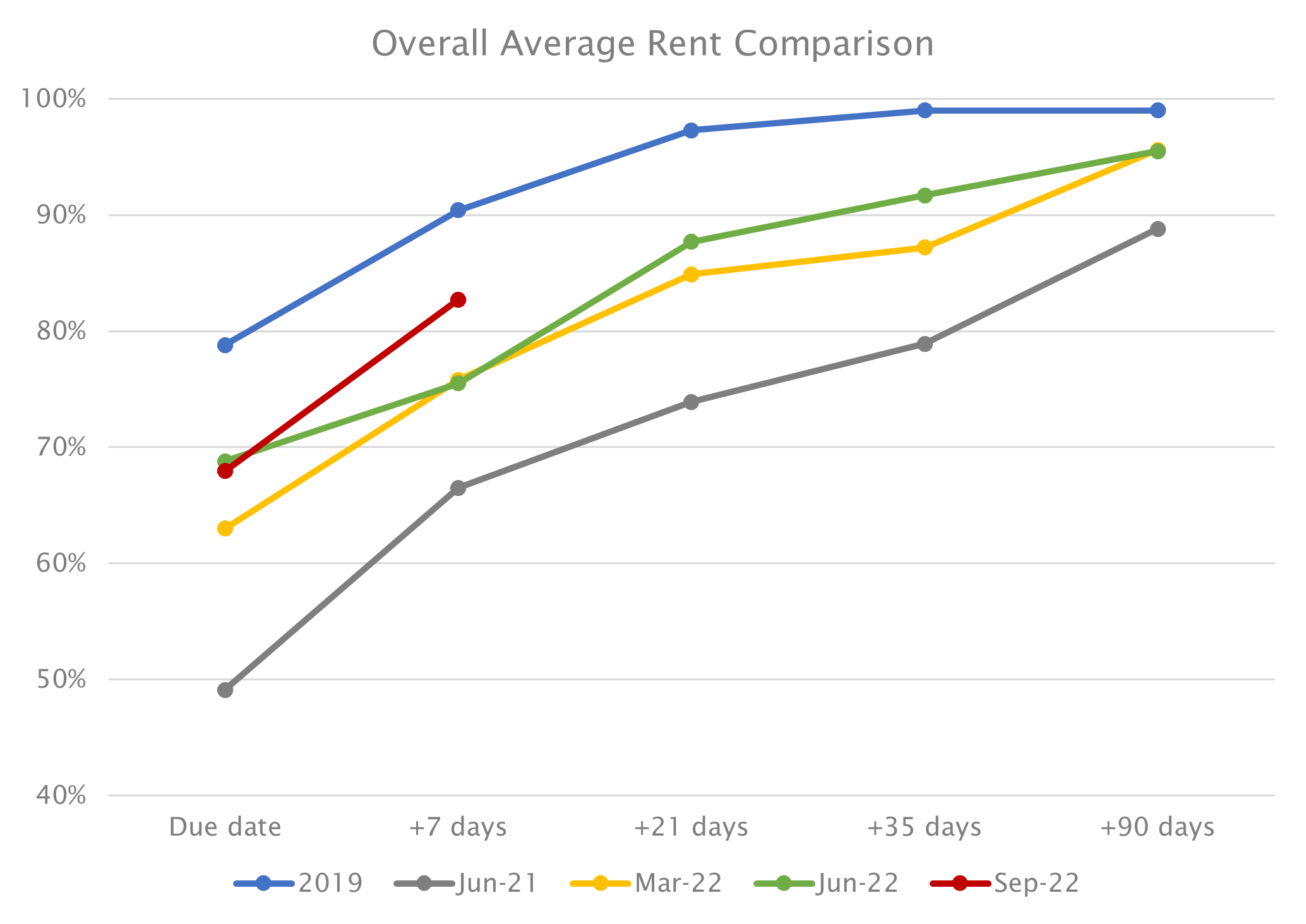

The collection of commercial property rents in the UK, seven days after the September quarter due date, has reached the highest level achieved for any quarter during the pandemic so far, according to the latest research from Remit Consulting.

The research covers around 125,000 leases on 31,500 prime commercial property investment properties across the country and the firm has recently launched an online portal to make it possible for building managers, investors, and asset managers to benchmark individual properties and portfolios against the market in real-time.

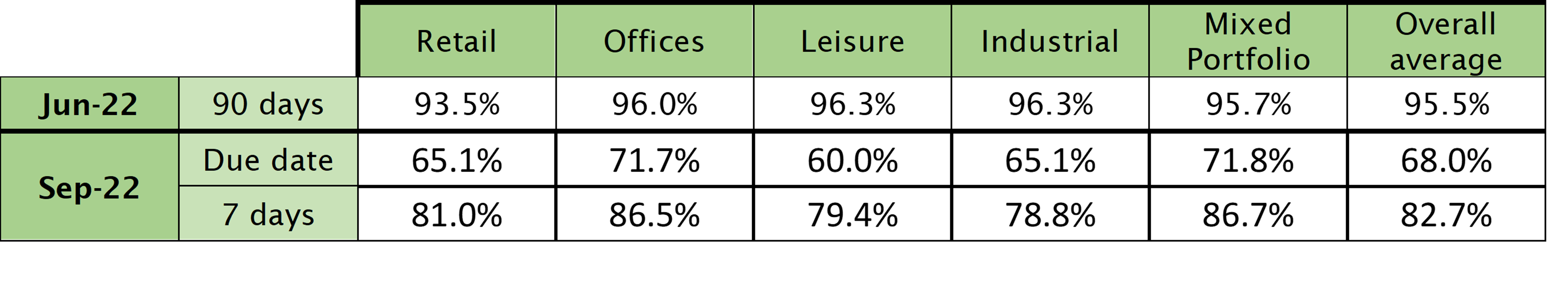

The figures for collection of rent and service charges, which are verified by the country's major property management agents, reveal that overall, an average of 82.7% of rents due from tenants of commercial property, were collected within seven days of the due date. This compares to a figure of 75.5% collected at the same point in the previous quarter and over 10% higher than collection rates at the same point in 2021.

However, Remit Consulting’s ReMark Report also reveals that at the end of the June Quarter 4.5% of all rents were still unpaid, 90-days after the payment due date. The end-of-quarter figure for the June Quarter was 0.1 percentage points lower than the March 2022 Quarter and indicates that collection rates have plateaued.

Laura Andrews of Remit Consulting said: "We witnessed a rapid increase in the collection of rents and service charge payments over the first seven days of the current quarter, which is positive news for investors and landlords. However, the total rent collected at the end of the previous two quarters has not changed and remains below the figures of over 99% experienced before the pandemic.

“While the impact of the pandemic is lessening, other economic factors, such as the energy crisis, consumer confidence and higher costs, are now adding to the woes of businesses, and it remains to be seen if a 4-5% shortfall in rent collection each quarter is the new normal?” she added.

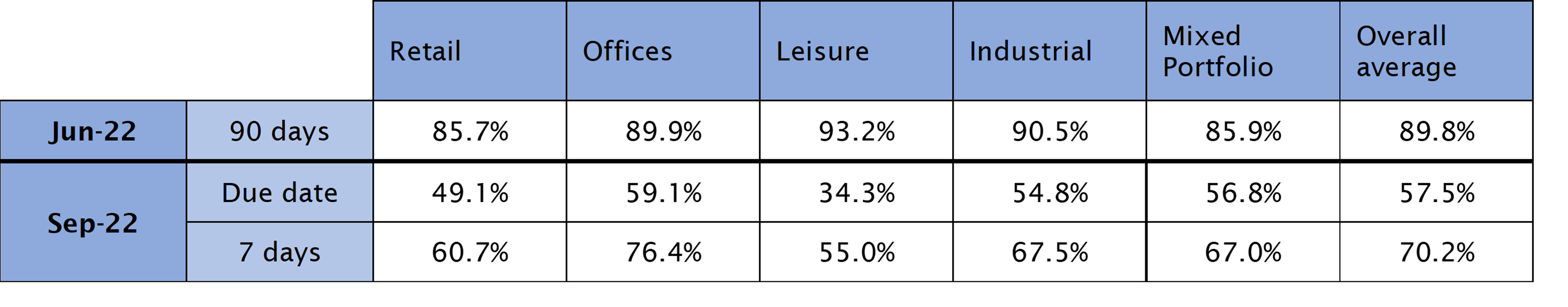

According to Remit Consulting, there is also a shortfall of around 10% in the collection of service charge payments from tenants of commercial properties.

Elijah Lewis, the firm’s research consultant, said: "At the end of the June Quarter, overall, 89.8% of service charge payments had been collected. While this is an improvement on the 85.3% seen at the end of the previous quarter, it is still well below the figures experienced before the pandemic and represents a significant shortfall for landlords and investors. With costs spiralling, this is a situation that building managers and owners will want to monitor closely.

“With inflation at a 40-year high of over 10%, companies and consumers are feeling the impact of a reduction in their purchasing power, and there is an expectation that defaults in rent payments will increase. As the current quarter progresses, we will continue to monitor collection rates to see if they drop and whether the gap between the rent service charge collections widens,” he added.

Working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Property Advisors Forum, and other members of the Property Industry Alliance (PIA). Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since March 2020.