News Release: Payments of rent owed by UK business occupiers fell by 3.5% on March Quarter Day

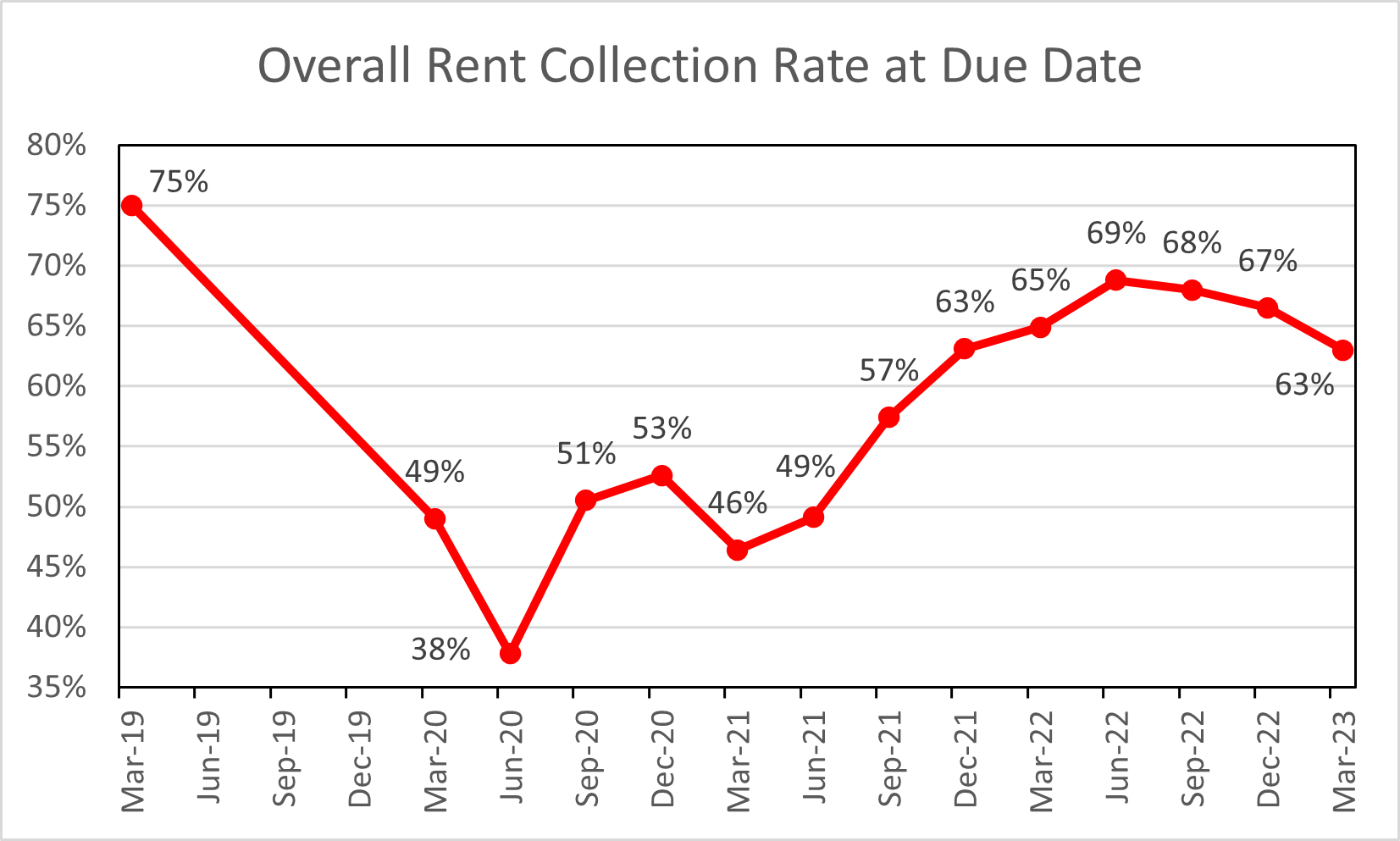

- Just 63.0% of rents owed to landlords were collected on March Quarter Day

- Remit Consulting’s research reveals worst levels of rent payment on due date since September 2021

The collection of rent on commercial properties due on March Quarter Day (2023) was the lowest recorded since September 2021 and the second-lowest figure recorded since the end of the lockdown restrictions, according to the latest research by Remit Consulting.

The management consultant’s ReMark report, which is based on verified figures submitted by the country's major property management agents, reveals that on the March Quarter Day, the traditional due date for the collection of rents on commercial property, just 63.0% of rents due were paid overall. This was a fall of 3.5 percentage points compared to the figure recorded three months previously on December Quarter Day (Christmas Day) and 2.1% lower than recorded 12 months previously in March 2022.

Remit Consulting's report also confirms that, at the end of the previous quarter, 96.5% of all rents due on Christmas Day had been collected, which, conversely, was the second-highest total collected for any quarter since the first national lockdown in the spring of 2020.

"While slow collection of rents at the beginning of financial quarters are not uncommon, it is concerning that at the start of the current period, there was a significant fall in payments made by tenants of commercial property, particularly compared to the previous quarter, which included the Christmas period that effects collections. Payments of rent on the due date have been heading back towards pre-Covid levels until now, and collection levels had been gradually increasing each quarter since December 2020, but this reversal in that trend is concerning," said Elijah Lewis, of Remit Consulting.

"The recovery from the pandemic was always going to be a bumpy road, and it remains to be seen if this is a sustained drop in rent payments or just another blip. However, investors, asset and property managers will be monitoring collection levels closely over the coming weeks, to see if they recover," he added.

Commenting on the report's findings, Richard Hart Head of Property Management at Workman, the UK’s largest independent commercial property manager, said: "The fall in rent and service charge payments at the start of the March quarter is an area of concern, while banks remain nervous about business and property loans, we should not be complacent regarding the potential for tenant default and the ability of business tenants to pay in full what is due. The spectre of insolvencies, particularly in the retail market, has certainly not disappeared."

The low levels of rent payments were particularly noticeable in the retail, industrial and office sectors. The retail sector showed a near 10% collection rate drop compared to the December quarter, showing the Christmas boon was short-lived and that the retail sector may be in for a tough time in the coming months. The office sector also struggled compared to last month, with the collection rates 2.5% down from December. This is particularly surprising as last quarter’s figures were particularly low given the collection days were on national holidays, warranting some questions about the historic belief that offices were a solid investment.

The latest REMark report also highlights that payments of service charges by commercial occupiers were, also, significantly lower overall compared to the previous quarter and the figures for March 2022, with certain sectors performing worse than others. With increasing inflationary pressure on service charge costs adding to a tenant’s total occupational costs, there is anecdotal evidence that many business occupiers continue to prioritise rental payments.

Rent collection by sector (March 2023)

Remit Consulting’s research covers around 125,000 leases on 31,500 prime commercial property investment properties across the country and the firm has recently launched an online portal to make it possible for building managers, investors, and asset managers to benchmark individual properties and portfolios against the market in real-time.

Working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Property Advisors Forum, and other members of the Property Industry Alliance (PIA). Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since March 2020.