News Release: Slowdown in UK businesses paying their rent on time.

- Remit Consulting’s research reveals the worst levels of rent payment by office occupiers since the depths of Lockdown (Q3 2020)

- Just 63.5% of rents owed to landlords by business occupiers in the UK were collected on June Quarter Day

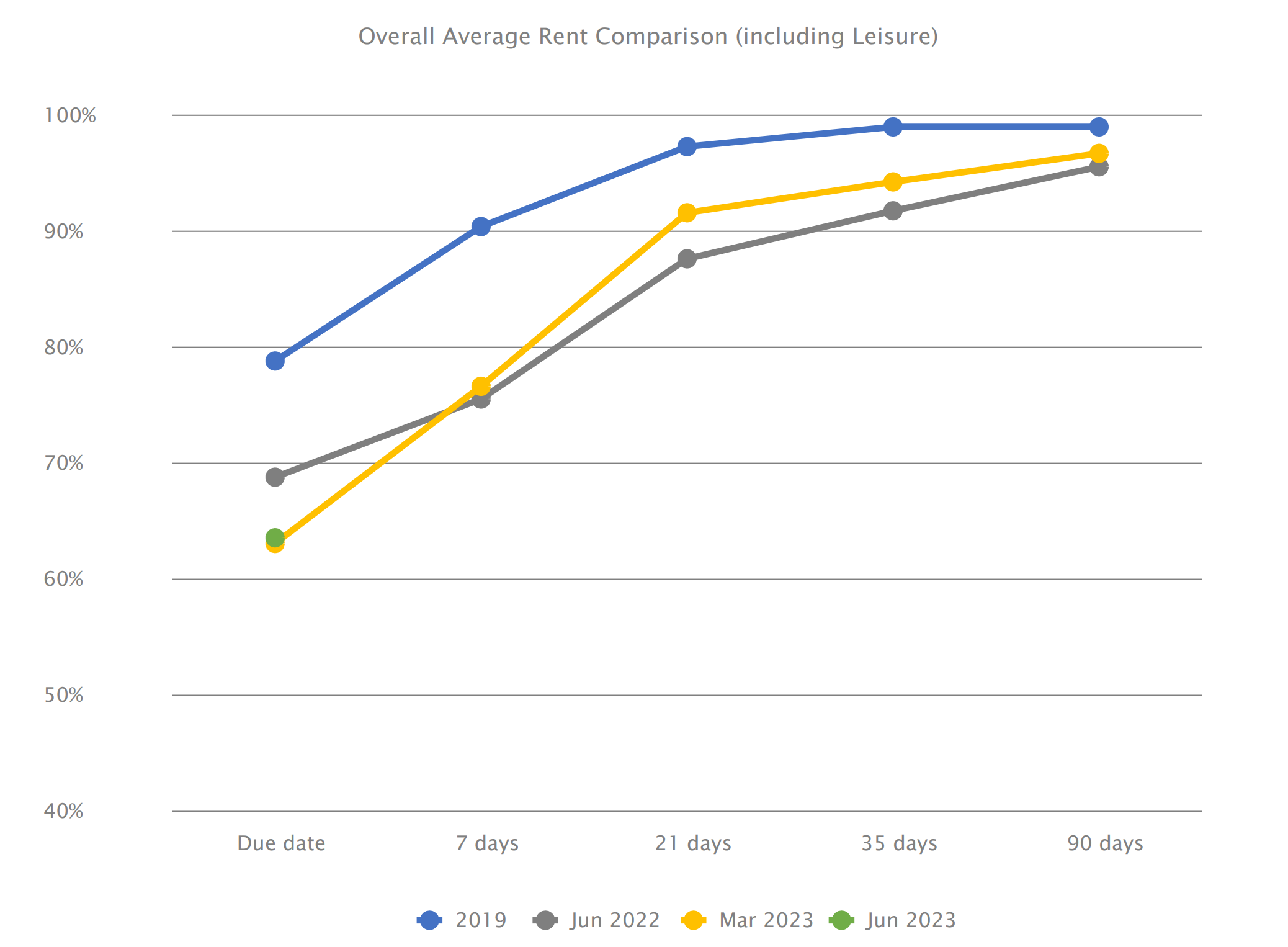

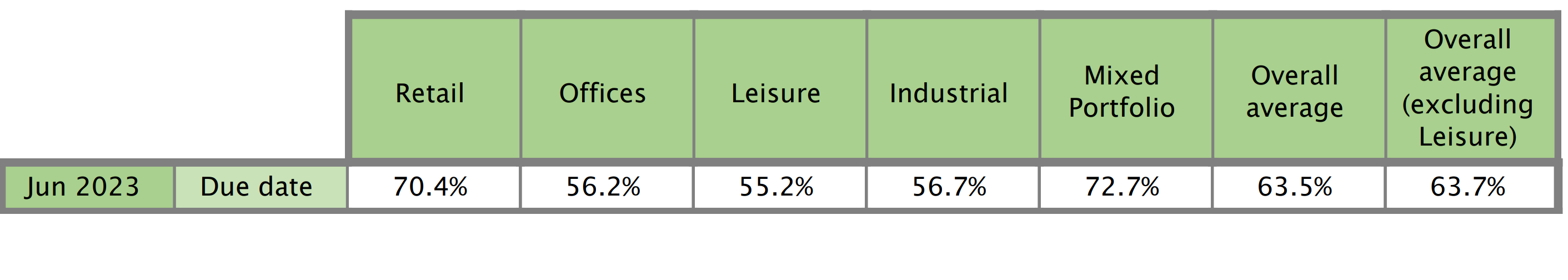

The collection of rent on commercial properties remains slow, according to the latest research by Remit Consulting, with just 63.5% of the rent payable to landlords and investors on June Quarter Day (24th June) being paid on time.

The management consultant’s ReMark report, which is based on verified figures submitted by the country's major property management agents, reveals that on the June Quarter Day, the traditional due date for the collection of rents on commercial property at the start of the third quarter of the year, just 63.5% of rents due were paid overall. This is a drop of 5.3 percentage points compared to the figure recorded twelve months previously, in June 2022.

The retail sector, which suffered widely in the early stages of the pandemic, saw one of the highest collection rates at the start of the new quarter, with 70.4% of rents due being paid on time. The industrial and office sectors performed badly, with 56.7% of industrial rents being paid on time, and just 56.2% of office rents being paid by occupiers.

Remit Consulting's report also confirms that, at the end of the second quarter, 96.7% of all rents due on March Quarter Day had been collected, which, conversely, was the joint highest total collected for any quarter since the first national lockdown in the spring of 2020.

Elijah Lewis, of Remit Consulting, said, "As we have seen throughout the pandemic, the slow collection of rents at the beginning of financial quarters is not uncommon. However, in a reversal of the fortunes of the three main market sectors, it is the retail market which sees the promptest payment of rent, while, in a trend that started twelve months ago, the office sector, which was consistently the most prompt in paying rent during the worst of the pandemic, now has the slowest payment levels.

“Remit Consulting’s parallel research project, which looks at office occupancy rates, reveals that the volume of staff returning to the office plateaued during the first half of the year, with a national daily average occupancy rate of around just 30%. The data underlines that hybrid working patterns are now being widely accepted by businesses, leading to a reduction in the amount of office space needed by many companies. It is possible that this reduced demand may be filtering through to slow rental payments,” he added.

Within the office market, rental payments regarding properties in out-of-town and business park locations were 21.6% lower on the due date than standard offices. The disparity between the two subsectors is a significant trend that began twelve months ago.

Remit Consulting’s research covers around 125,000 leases on 31,500 prime commercial property investment properties across the country and the firm has recently launched an online portal to make it possible for building managers, investors, and asset managers to benchmark individual properties and portfolios against the market in real-time.

Working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Property Advisors Forum, and other members of the Property Industry Alliance (PIA). Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since March 2020.