News Release: September Quarter Day 2023 highest rent collection rates since the start of the pandemic.

- Highest rent collection from tenants of commercial property in the UK since the start of the pandemic.

- Positive news for the UK's commercial property market as UK businesses continue to distance themselves from the pandemic's ramifications.

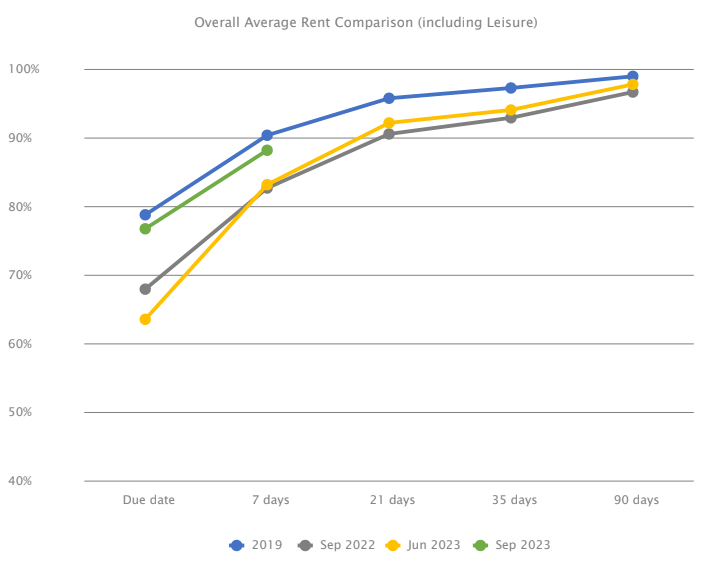

September Quarter Day 2023 saw the highest rent collection from tenants of commercial property in the UK, on the due date since the start of the pandemic, according to the latest research from Remit Consulting, which covers around 125,000 leases and roughly £2 billion in rent demands.

Analysing verified figures submitted by major property management firms, Remit Consulting’s REMark Report reveals that 76.8% of rents on commercial properties were collected on the due date at the start of the fourth quarter, rising to 88.2% within seven days.

By comparison, Q3 2020 saw the lowest rent collection on the due date at a mere 37.8%.

Elijah Lewis, head of research at Remit Consulting, said: "The rent collection rate at the start of the current quarter is the most robust we have witnessed since 2019, both on the quarter day due date and seven days following.

“Although we have seen a gradual increase in collection rates since the start of 2020, there were hints of a decline during Q2 and Q3 this year, with payments on the due date barely crossing the 65% mark. However, this quarter signals a pivotal shift back towards the healthier figures of 2019.

“The retail sector, which has previously lagged behind other sectors, showed a significant rally in the third quarter, and it is now aligned with the national average. Investors will be encouraged by what appears to be a sustained improvement in rent payments by High Street businesses.”

Occupiers are beginning to make decisions about how much office space they need and are now occupying offices that suit their commercial needs. Armed with insights on occupational trends, many seem to be opting for office space that precisely meets their commercial objectives, eliminating previous uncertainties related to lease terminations or relocations.

Surprisingly, the industrial sector started the quarter slightly behind other sectors, remaining 3.4% below the overall average after seven days. However, this should be viewed in context; and is less about the sector's underperformance and more about the exceptional performance of the entire industry. Mirroring other sectors, industrial saw its best rent collection in the initial seven-day period of the current quarter compared to any previous ones since the start of the pandemic.

Rent collection rates, September 2023 (by sector)

| September | Retail | Offices | Leisure | Industrial | Mixed Portfolio | Overall average |

| Due date | 77.1% | 76.7% | 73.9% | 72.5% | 81.8% | 76.9% |

| 7 days | 88.2% | 89.4% | 88.7% | 84.8% | 90.1% | 88.2% |

Remit Consulting’s report suggests the turnaround is not solely attributed to economic recovery, with property managers taking a proactive approach and strategic implementation of better rent collection methods playing a pivotal role.

“The current financial landscape, particularly with the base rate pegged at 5.25%, also seems to have influenced a swift collection drive, ensuring stakeholders capitalise on the high-interest rate environment,” said Elijah Lewis